Credit Score Tips and Tricks

Written By: Miller and Associates Realty On: 11th December 2014 Under: Tips

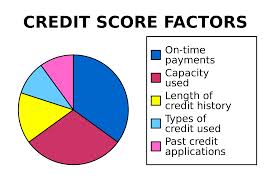

Our credit scores are something everyone tries their best to maintain. Without a decent credit score, it is nearly impossible to purchase a car, house, or anything that requires your score. By managing your money and your credit cards, you can begin to increase your score over a period of time. To help make it easier for your purchase on your next house we have provided a few ways to help you credit score out.

- Keep your debt- to – credit ratio below 30%. This means never max any of your cards out. When you max your cards it makes the banks think you have no other money. Pay down your balances instead of paying them in full. This way your utilization ratio is low.

- Eliminate multiple balances, instead of using multiple cards. By racking up charges on a bunch of different cards, you make it to where you have a lot of balances on different cards. Stick to one or two cards for all of your expenses.

- Continue good debt; the longer you are consistent with your payments the better your score will get. Gradually it will rise by the consistency of payments. When you stick to using one or two cards and paying on them on time you let the banks see that you can be responsible with your money.

- Do not procrastinate when shopping for a new home or car. When running your credit scores, it puts a small dip in your score for a year. Within the first 30 days, the banks do not see recent hits, so it is crucial to make a buy fast if you have decided you want to purchase. Keep a calendar of your purchases and keep track of when your payments are due.

- If you want to make a big purchase do not neglect your other bills to try and save money to put down on your house or car. Make sure you pay the other bills then assess your money to see if you can afford the new payment.

- When it comes to credit cards, be consistent with your usage and your payments. If you all of the sudden use it more, or are paying less it will affect your credit. By doing this it makes it look like you are reliant on the money on the card.

- Stagger your reports if you are looking into a new car and a new house, do not try to do it all at once.