Turnabout is Fair Play

Written By: Miller and Associates Realty On: 31st December 2012 Under: Real Estate Market, Real Estate News

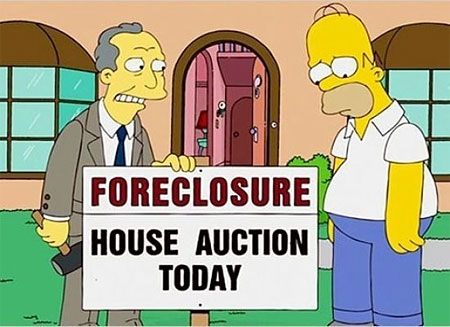

Almost half a million Florida properties have been foreclosed upon since the market crashed, a large number of which are still up for sale. Many people do not realize, however, that when these banks take over ownership they also take over responsibility for all HOA fees associated with the property. This includes all unpaid fees as far back as one year and, of course, any new fees incurred until such time as the property is sold. In a strange twist, unsurprising to some, it is now the banks who are being foreclosed upon or having liens placed against them for failing to pay! Obviously, when these fees go unpaid, the other members of the associations are left to pick up the slack or the property is left without maintenance, utilities, and trash services. In some cases, these fees can add up to significant amounts. A recent case filed against JP Morgan is suing for over twenty five thousand dollars in fees that have been delinquent for two years. One association in Pembroke Pines is owed over one million dollars in back fees on foreclosed homes! In the vast majority of these cases, well over ninety percent of the time, the banks resolve the issue by paying up. In an interview with a Miami based attorney who had handled nearly thirteen hundred of such cases, he could only name a single instance where the foreclosure went all the way through to the auction of the bank owned property to pay the associated fees. In some cases, the banks attempt to defer the fees to the mortgage servicing company but, typically, it is the bank who becomes official title holder after foreclosure. Moral of the story: even banks have to pay their bills!